Developing and establishing a brand positioning

9 Topics | 1 Quiz

Other Competitive Strategies

3 Topics

Increasing Market Share

In some markets, one share point can be worth tens of millions of dollars, which is why competition is so fierce. Because the cost of buying higher market share through acquisition may far exceed its revenue value, a company should consider four factors first:

- The possibility of provoking antitrust action. Frustrated competitors are likely to cry “monopoly” and seek legal action if a dominant firm makes further inroads. Microsoft and Intel have had to fend off numerous lawsuits and legal challenges around the world as a result of what some feel are inappropriate or illegal business practices and abuse of market power.

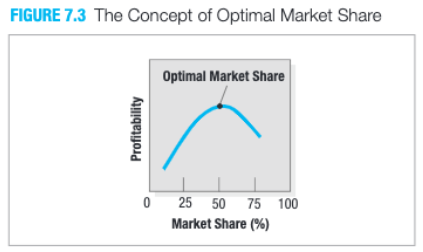

- Economic cost. Figure 7.3 shows that profitability might fall with market share gains after some level. In the illustration, the firm’s optimal market share is 50 percent. The cost of gaining further market share might exceed the value if holdout customers dislike the firm, are loyal to competitors, have unique needs, or prefer dealing with smaller firms. Pushing for higher share is less justifiable when there are unattractive market segments, buyers who want multiple sources of supply, high exit barriers, and few economies of scale.

- Pursuing the wrong marketing activities. Companies successfully gaining share typically outperform competitors in three areas: new-product activity, relative product quality, and marketing expenditures. Companies that attempt to increase market share by cutting prices more deeply than competitors typically don’t achieve significant gains because rivals meet the price cuts or offer other values so buyers don’t switch.

- The effect of increased market share on actual and perceived quality. Too many customers can put a strain on the firm’s resources, hurting product value and service delivery