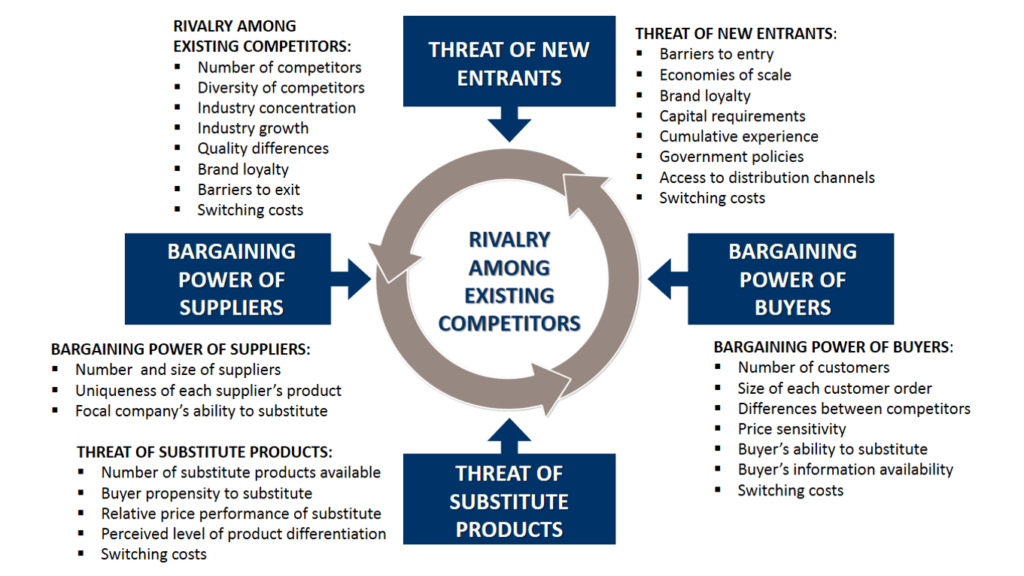

The 5 Forces by Michael Porter

Michael Porter has identified five forces that determine the intrinsic long-run attractiveness of a market or market segment:

- industry competitors,

- potential entrants,

- substitutes,

- buyers, and

- suppliers.

The 5 Forces model by Porter

Porter’s Five Forces is a model that identifies and analyzes five competitive forces that shape every industry and helps determine an industry’s weaknesses and strengths. Five Forces analysis is frequently used to identify an industry’s structure to determine corporate strategy. Porter’s model can be applied to any segment of the economy to understand the level of competition within the industry and enhance a company’s long-term profitability. The Five Forces model is named after Harvard Business School professor, Michael E. Porter.

The first is the threat of intense segment rivalry. A segment is unattractive if it already contains numerous, strong, or aggressive competitors. It’s even more unattractive if it’s stable or declining, if plant capacity must be added in large increments, if fixed costs or exit barriers are high, or if competitors have high stakes in staying in the segment.

The second is the threat of potential entrants. The most attractive segment is one in which entry barriers are high and exit barriers are low. Few new firms can enter the industry, and poorly performing firms can easily exit. When entry and exit barriers are high, profit potential is high, but firms face more risk because poorer-performing firms stay in and fight it out. When entry and exit barriers are low, firms easily enter and leave the industry, and returns are stable but low. The worst case occurs when entry barriers are low and exit barriers are high: Firms enter during good times but find it hard to leave during bad times.

The third is the threat of substitutes. A segment is unattractive when there are actual or potential substitutes for the product. Substitutes place a limit on prices and on profits. If technology advances or competition increases in these substitute industries, prices and profits are likely to fall.

The fourth is the threat of buyers’ growing bargaining power. A segment is unattractive if buyers possess strong or growing bargaining power. Buyers’ bargaining power grows when they become more concentrated or organized, when the product represents a significant fraction of their costs, when the product is undifferentiated, when buyers’ switching costs are low, or when they can integrate upstream. To protect themselves, sellers might select buyers who have the least power to negotiate or switch suppliers. A better defense is developing superior offers that strong buyers cannot refuse.

The fifth force is the threat of suppliers’ growing bargaining power. A segment is unattractive if suppliers are able to raise prices or reduce quantity supplied. Suppliers tend to be powerful when they are concentrated or organized, when they can integrate downstream, when there are few substitutes, when the supplied product is an important input, and when the costs of switch-ing suppliers are high. The best defenses are to build win-win relationships with suppliers or use multiple supply sources.

KEY TAKEAWAYS

- Porter’s Five Forces is a framework for analyzing a company’s competitive environment.

- The number and power of a company’s competitive rivals, potential new market entrants, suppliers, customers, and substitute products influence a company’s profitability.

- Five Forces analysis can be used to guide business strategy to increase competitive advantage.

Examples of the forces